Demand Concerns Weigh on Metals as China’s Economy Slows Down

Metals have suffered a significant setback as China’s economic growth slows down. The demand concerns have weighed heavily on the metal market, leading to a sharp decline in prices. Silver futures saw their largest one-day percentage loss in over three months, while copper futures settled at their lowest since November.

Factors Contributing to China’s Economic Slowdown

China’s economic slowdown can be attributed to several factors. Trade tensions with the United States, rising debt levels, and a slowdown in the property market have all contributed to the country’s economic woes.

Impact on the Metal Market

The slowdown in China’s economy has led to a decline in demand for metals, resulting in oversupply and declining prices. Copper, aluminum, and nickel are some of the metals that have been hit hardest by the decline in demand.

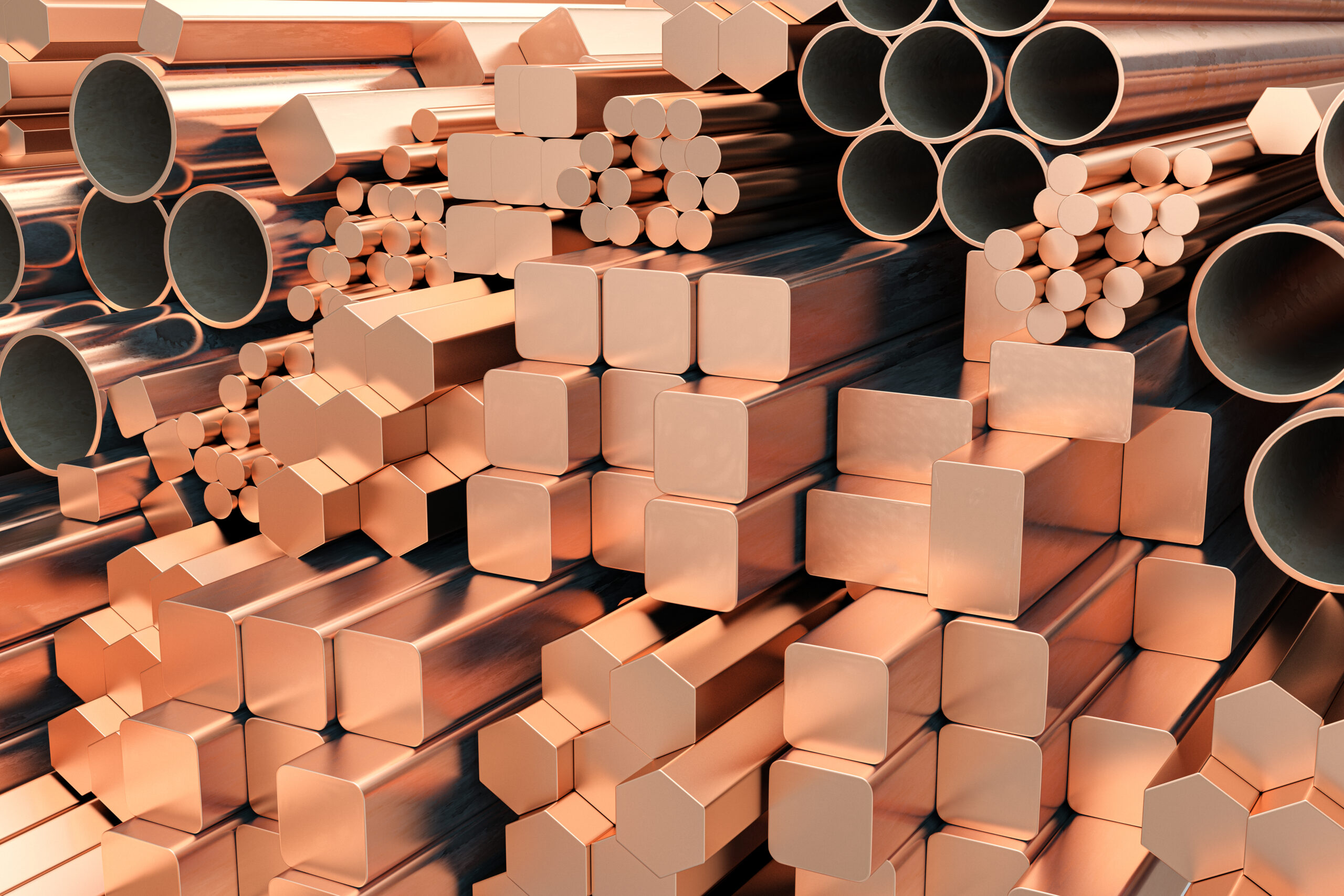

Copper

Copper is one of the most widely used metals in the world, with applications in construction, electronics, and transportation. However, with China being the largest consumer of copper, any decline in demand can have a significant impact on prices. In recent months, copper prices have been fluctuating due to concerns over China’s economic slowdown.

Aluminum

Aluminum is another metal that has been impacted by China’s economic slowdown. With China being the largest producer of aluminum, any decline in demand can lead to an oversupply in the market and a decline in prices.

Nickel

Nickel is used in the production of stainless steel, which is widely used in construction and manufacturing. However, with China being the largest consumer of nickel, any decline in demand can lead to a decline in prices.

Opportunity for Long-Term Investors

The current situation in the metal market presents an opportunity for long-term investors. As China’s economy recovers, demand for metals is likely to increase, which could lead to a rise in prices. Long-term investors may see this as a chance to purchase stocks at a discounted price.

Importance of Due Diligence

Investors should always conduct due diligence before investing in the metal market. This includes analyzing market trends, researching individual companies, and monitoring news and events that could impact the metal market.

Ways to Protect Against Fluctuations

Investors can protect themselves against fluctuations in the metal market by diversifying their portfolios, conducting due diligence, and monitoring market trends and news.

FAQs

Here are some frequently asked questions about the demand concerns weighing on metals as China’s economy slows down:

1. What impact has China’s economic slowdown had on the metal market?

The slowdown in China’s economy has led to a decline in demand for metals, which has resulted in oversupply and declining prices.

2. Which metals have been most affected by the decline in demand?

Copper, aluminum, and nickel are some of the metals that have been hit hardest by the decline in demand.

3. How can investors protect themselves against fluctuations in the metal market?

Investors can protect themselves against fluctuations in the metal market by diversifying their portfolios, conducting due diligence, and monitoring market trends and news.

4. Is there an opportunity for long-term investors in the metal market?

Yes, the current situation in the metal market presents an opportunity for long-term investors. As China’s economy recovers, demand for metals is likely to increase, which could lead to a rise in prices.

5. What should investors keep in mind when investing in the metal market during China’s economic slowdown?

Investors should keep in mind the short-term volatility in the market, the importance of diversification, the opportunity for long-term investors, and the importance of conducting due diligence before investing.

Conclusion

The demand concerns weighing on metals as China’s economy slows down have had a significant impact on the metal market. While the short-term outlook may be uncertain, the long-term outlook for the metal market is positive as the demand for metals is likely to increase as China’s economy recovers. Investors should keep in mind the importance of diversification, due diligence, and monitoring market trends and news to protect themselves against any fluctuations in the metal market.